tv [untitled] January 17, 2013 11:30am-12:00pm EST

11:30 am

oh bankers think that they have managed to split the atom of risk from the of reward they keep all the reward we keep all their risk and with this i want to first look at this chart from the economist magazine now they asked a condiments the average person on the street whether or not they agree with the statement it is hard to predict stock prices one hundred percent of a condom is agreed that you cannot predict stock prices only fifty five percent of the general public agreed so forty five percent think you can predict stock prices well yes this is that they're called close or they are they become plaintiffs. economists know that you can't predict outcomes. but they tell people you know you see this all the time that they can predict outcomes and that's the snake oil that is

11:31 am

a wonderful wacky world of wall street and the city of london and the vulnerable to this of course all these huge passion funds that end up getting their capital erased because some slick salesman said we know what's coming down the pike ignore a common sense ignore your instincts take our advice instead and they get they get wiped out now of course you also invented a prediction market one of the first out there hollywood stock exchange at h s x dot com and i think you also highlighted with. one of the problems with this here that economists in their ivory tower say no you cannot predict outcomes but in the real world. whether it's high frequency trading derivatives or manipulation the real world bankers are able to predict outcomes they were able to predict the price of libel or you know they're able to predict because they're able to create that price well they're manipulating the price and if you know the price

11:32 am

that you're manipulating to and around you can predict where that price is going for example high frequency trading are not going to training as practiced by wall street by goldman sachs and j.p. morgan they will pick a price around the current price either higher or lower then they'll flood the market with quote stuffing or other forms of high frequency trading and algorithmic trading to fill in all the trades to get to that price so price discovery has been turned on its head it used to be that nobody knew what the price would be after all the market participants bought and sold around something called price discovery now it's reversed now the price is known ahead of time by jamie diamond and j.p. morgan goldman sachs and they just fill in a lot of trains to get to a pre-determined price that some of these banks continue to make record profits they're not taking any risk and that's a key difference as you pointed out the beginning with this new version of pseudo capitalism where banks take no risk they just take all the reward and they use computers to pick prices ahead of time and then fill in all the trades to make

11:33 am

a look as though there was some market activity to get to that price but that's completely false also the bankers have used this notion that they are just hedging they're just hedging they're not taking any positions against their clients or against the global economy in fact with their derivatives and their rigging and manipulation one of these was a bank who claimed only months ago that they actually made no profit from the rigging of libel or that they took no position they were only hedges well major bank made six hundred fifty million dollars betting on rigged interest rate according to the wall street journal doing. the bank made six hundred fifty four million dollars trading on libel or another interest rates in two thousand and eight and one former employee says the bank's executives blew off warnings about the riskiness of such trades because quote the bank could influence the rates they were betting on that's absolutely right don't you bank now they act both as hedgers

11:34 am

and as market makers so what that means basically is i don't your bank sits in the middle of the market and estrange come in from all different sources they cherry pick the trades if they'd like to keep themselves knowing ahead of time what the outcome will be of whether it'll be profitable or not and the losing trades they simply dump in other people's accounts and they do this all day long and so does so to other other market makers and hedgers like a goldman sachs i mean lloyd blankfein told charlie rose in new york city this is exactly what they do or jim cramer told and task is now marketing that this is exactly how he make money when he managed to hedge on wall street by cherry picking trains in a minute of way by being ahead of the market maker simultaneously that's not capitalism that's fraud well according to this story the interest rate bets included an estimated profit of twenty four million euros each one hundredth of

11:35 am

a percentage point that the three month u.s. libel or increased compared with a one month u.s. dollar libel or according to the documents because of the vast size of the derivatives pool a lot of the general population doesn't have the anger about these massive crimes because they think it's one hundredth of a percentage of a libel or rate move that would have seen them making twenty four million euros profit but these sort of tiny moves with huge profits it just leaves the audience the population at large who should be pressuring the department of justice to do something about this they just think well i don't know about this well this is where paul krugman gets a completely wrong paul krugman. advocates of the government expand their balance sheets expand the debt load go deeper into debt expand the bond issuance expand the size of the federal reserve balance sheet and jamie dimon j.p. morgan's balance sheet central banks and commercial banks want the debts to be as

11:36 am

high as they possibly can from what you're just saying because they can apply that fractional percentage point of fraud over vastly larger pools of capital you know it's not for nothing they're around six hundred trillion dollars worth of derivatives it's not an accident that the central banks have hundreds of showings of dollars worth of debt that all the major g. twenty countries are severely in debt that's where banks are able to fish for risk once profits the bigger the debt the easier it is for them to risk for risk profits they love the debt because it's easier for them to commit fraud and to suck capital out of the system and pay them some she's bonuses now the other risk of course is that one day people will recognize what has happened to them and that risk we're seeing result in the emergence of a new trend which is the so-called libertarian communes now this is one of the things i have always maintained about the american school of libertarian and that is that they're kind of like the one nine hundred sixty s.

11:37 am

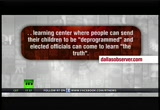

and seventy's wave of hippies who formed communes as well to live in this world of peace and love and they all ended up with gonorrhea and syphilis and stabbing each other and twisted romance and that's what happened there was a party. said glenn beck is planning a two billion dollar libertarian commune in texas so it's going to have an amusement park they're going to produce their own energy and food but it looks like a big entertainment complex all of that of one nine hundred eighty four with the big face of glenn beck reeducating everybody because he does say there will be a learning center where people can send their children to be d. pro. ground and elected officials can come to learn the truth well as put aside for a second the question of whether or not glenn beck. and less focus instead on the strand of libertarian paradise construction by folks like glenn beck and

11:38 am

others who have raped of the economy the american economy is not coming back neither is the british economy because the banks committed what's called a scorched earth being decimated the economy there is no potential for growth or jobs coming back because it's been utterly destroyed and glenn beck and these other folks know this so they're busy building castles surrounded by moments and on guns to try to hold on to the money that they stole but indeed in fact one of the at the forefront of this has been koch industries they've been behind the notion that workers should get paid less and less that you should compete with china so developer pitches one billion dollar commonwealth for belle isle a group of billionaires who have made their fortunes from corporate welfare want to turn an island park located in the detroit river into an offshore tax saving the guys behind this one of them was the former head of chrysler who drove with lee iacocca to washington d.c. to get jimmy carter at the time to bail out chrysler putting aside for

11:39 am

a second the question of whether or not the koch brothers. you know this reminds me of the crusaders you know who would go into these muslim countries and bill will tassels and course they couldn't leave the can they just have their guns sticking out little portholes and it's all very insular and incestuousness and they ended up giving birth to some children that reflected in incestuous nature i would imagine the comp others coming in the glenn beck. you know ten or fifteen years a lot of babies from glenn beck's come you know look like glenn beck but slightly deformed but also let's look at the result of the real world of these ideal a libertarian society top tip if you're going out of beijing don't breathe so this is my way way war one of these men. because in beijing this week where there are no regulations against any of the sort of koch industries you could spill any toxic chemicals waste anything well you people are having to walk around with gas masks on beijing municipal environmental monitoring center says levels of two point five

11:40 am

tiny particulate matter had reached more than six hundred micrograms per square meter in many areas and reporters said it had even hit nine hundred is worse ever reading the world health organization considers a safe daily level to be twenty five so tens and tens of times more than is safe right so did the scorched earth policy the libertarian the austrian school to some degree obliterated the earth's ability to generate a viable economy and now they're worried and they're frightened they're building castles to live with going back and give birth to incestuously affected little babies now finally fed orders j.p. morgan to fix risk after a london whale no fine for them now no danger no risk for them of any consequence to their actions and in fact this mass comes back in for the final headline j.p. morgan c.e.o. jamie dimon pushes for banks to publicly shame him he wants the banks of publicly

11:41 am

shamed him i think you must have read fifty shades of grey je t'aime is down to s. and m. and kinky so flagellation all right jamie i thought you had become completely irrelevant but i see your stick and where they're going to be viewed i'm more looking for stacy i'm getting hot but look at you know that. to. me as you are all this. you know oh you stay tuned for the second half of the spending with dumbo are on their of the devils to. deadly rivals some decades. if you had fifteen thousand people killing each other in any other country there would be diplomats there would be mediators.

11:42 am

self-imposed out costs from society i will attack myself and michael attack my brother understand my contact immediately. going to basically attack the columns of my anger and my frustration. that. well into the dome. two of the most violent gangs in u.s. history. is just all model kill or be killed with the colors matching the national flag.

11:43 am

11:44 am

author of the devil's derivatives there it is the devil's derivatives get a good shot of this this is the book you gonna read also another classic instant classic inventing money making dunbar welcome to the kaiser report thanks much the devil's derivatives this is a key text in understanding how we got to where we are today because it goes back to rivet is and long term capital management which is discussed in this book inventing money also a key. point in the history let's talk a long term capital management for a second and derivatives and what your take this was the huge hedge funds that. collapsed in one thousand nine hundred eight is actually the last time that russia defaulted. and there was a lot of turmoil and the global markets around that time. was seemingly unconnected

11:45 am

to all these things but was pulled down by the volatility in the markets and was bailed out by a consortium of the world's biggest investment banks and at the time it seemed that that was a warning shot across the bows of regulators around the world that the shadowy over the counter through this market was something that needed to be examined a bit more carefully and i wrote that book with partially to try and put that warning across and we saw. instead. over the following to cade's and we got to where we were today which is a much bigger crisis. right now long term capital management many would argue as you are suggesting in a seminal event in a few different. themes one would be the federal reserve under alan greenspan rushed in to drop interest rates to. certainly low levels to bail out long-term capital management so in other words all of the savers out there who are on savings

11:46 am

rates fixed income etc end up subsidizing this has fun in greenwich connecticut number two enormous leverage bets that war fifty sixty seventy to one which in an economy like this again why would the fed be subsidizing this gambling approach to the markets three you've got a theme too big to fail i think this is maybe the most important thing because here you have long term capital management a hedge fund in greenwich connecticut that put a gun to the fed's head said give us cheaper money bell south or this entire global economy is going to go under and that's the thing we start with hank paulson during the two thousand and eight we saw with the banks here in the u.k. with the royal bank of scotland barclays are lawyers threatening the government banks in america threatening the government and just down the fiscal cliff and the debt ceiling banks threatening the government give us money or requests the system . it all kind of comes from long term capital management i think what your thoughts

11:47 am

are you think you're quite right i mean the too big to fail concept started then i think that was the you know the d.n.a. got into the system about point he was slightly different from what happened two thousand and eight because this joint hedge fund officially was going to be dismantled what happened what greenspan did by cutting rates in your muscles and really to save long term capital management because it was wound down its founders lost their money and that was the end of our business but it was really to save the counter parties or the long term careful management which was the likes of j.p. morgan deutsche bank u.b.s. you name the guys in that space so it was the links between this this giant hedge fund the big dealers and over the counter derivatives that they couldn't be allowed to fail and they still can't be allowed to fail today was really the link that we need to make let's talk about derivatives a little bit. most people gets stumble on the term but you could distill it into

11:48 am

one very simple concept and that is it's a bit. absolutely it's a battle of some kind on the line to see whether it's an interest rate a currency a stock price or a credit default something like that it's a bet they can go either way it's called no purpose except to convey that betty doesn't have a memory of who did it it's neutral with the girls the purpose so you want if you're going one side you can be protecting in something if you get the other side you can be speculating on something ok now like those one and sure print you know as sure famous graphic artist he would do these prints where the fish is going swimming in opposite directions and you can't tell which way it's going or it's an optical illusion and some would argue that this is what grid is market have become their bets on things that themselves there have become the collateral for bets on other things and then when you look closely it's a sell feeding allusion or delusion almost and that these bets are all referencing

11:49 am

each other and there is no collateral there is no basis for it. just to give a little historical perspective when i was in the business in the eighty's and ninety's we traded options an option is well understood it's in its essence a derivative year but you're buying at an auction a contract based on the underlying stock or bond and direction but with derivatives really you're talking about a bet or an option on an option and then we have five six seven eight ten generation derivatives where there's a bet on a bet on a bet on a bet until the point where the bets are all suffer a fragile and in fact it becomes a financial hole a gram i know that's a long question and a bit. poetic in the sense i suppose but what are your thoughts on that yes the idea is to be derivatives is that you can shift risk. and with banking back in the one nine hundred eighty s. the options market was was fairly small what banks did in wall street was they they

11:50 am

traded bonds and stocks and it was kind of like your own cooking problem if you if you had too much of your balance sheet and the market went the wrong way you're going to get that kind of kept wall street relatively honest back in those days what rigged to do is allow you to offset risk with the with other things so if you have a bunch of bonds and your balance sheet you can hedge the. derivative against that or anything you want and once you start doing that process then as you correctly said you can basically by mordor of sieves to hedge that and you can create new derivatives on the basis of this this infrastructure you create and even then you soon get to the situation where you have six hundred or trillion of these and the investment banks say that because they can then cancel risks out they can use these special models and lo and behold they've got like tiny amounts of equity and these huge numbers on their balance sheet say what we learn in two thousand and eight is

11:51 am

that's false they don't cancel each other out there's a credit freeze and you have a systemic collapse so that's a lie it's an online life but i want to talk about derivatives in another sense and it goes to the definition of capitalism itself in capitalism you've got entrepreneurs' taking risks by investing capital and the amount of reward that is expected in a capitalistic quezon has some commensurate tie to some quantity of risk and people who are willing to take risk. have to potential to make rewards and they may fail in which case they the risk is borne by the the entrepreneur and but we encourage the continuation of this in the hopes that some will be successful so you have though one of my point is he's got a connection between risk and reward that's not too difficult to understand derivatives. and the growth of derivatives that relationship has been destroyed

11:52 am

because now you have capitalists or bankers who are applying making bets but not taking any risk. and that's a huge problem because it totally upsets the whole definition of what capitalism about jamie dimon is j.p. morgan is not a capitalist because he's making riskless bets reaping the rewards when he's right and when he's wrong society ends up underwriting the cost that's not has anything to do with capitalism your thought. is exactly how it works. in banking when you trade if you take one risk and then you had it out with another bank's a few. goldman sachs you had it out with j.p. morgan. you basically can say you don't take any risk because you're flat and the more business you do because you get paid a percentage of the volume you do then that there will be all you need to do is to as much a volume as you can and it becomes a volume business rather than

11:53 am

a risk business ok let me jump in there if it's a volume business and not a risk reward business then that and we understand then why there's an emphasis on things like high frequency trading and algorithmic trading because you just pushing volume through the system to make the commissions to make those spreads but you're doing so riskless slowly and you're actually destroying liquidity and destroying the markets in a lot of way because in a real buyer seller shows up there's no real counter party to take that trade you end up again returning to the ash or ask like hola graham that are these markets where capitalism is dying but jamie diamond j.p. morgan goldman sachs our royal bank of scotland barclays are siphoning off the cash and the integrity of just like anybody sticking a tube and somebody gas tank and siphoning off the equity that's what they're doing where it's interesting to kind of you could say it's a slightly parasitical activity yes but you do need traditional players to be

11:54 am

able to do this so and i wrote about this in the book. that use that you have these sort of cautious investors like pension funds that you have to dish and. long term investors that will that want these safe investments and the game that wall street played in the city of london played the last decade was to was to craft these things that looked very safe and then that would help them achieve the volume because they would just pick hedging everything themselves and they were then sticking it into some package and then people over the world were buying it and that's where the that's the the fuel that drove that machine ok so now i call this reverse drug dealing you know the cocaine dealer will cut the coke was some something to stretch out the volume of his coke it starts off with high grade colombian yeah yo yo yo and you stretch it out to something that you

11:55 am

improve your volume but this is different wall street starts off with with derivatives that are worthless and then they cut it with a little triple a rated government bonds and suddenly the entire mess is rated aaa by the rating agencies correct where you said we need these enablers these rating agencies the regulators who rubber stamp the banks' balance sheets you need these enablers to to say this whole system works and that no one is there saying the emperor has no clothes so the rating for sovereign debt in the u.s. for example they have a another crisis debt ceiling the rating agencies are going to say we're going to cut your rating from aaa it was already downgraded once very few credits now in the world have aaa which means that the collateral holding up the devil's derivatives the really the biggest ponzi scheme of all if you thought i am i was a ponzi scheme it's nothing compared to the devil's derivatives so the collateral is collapsing nick dunbar even the ability to float massive ponzi scheme our

11:56 am

central banks related fraud by fraud meisters like jamie diamond east still need a aaa rated credit but now those are disappearing what's going to happen in six months from now when there is no aaa rated credit at all in the world and this whole gram of derivatives chicanery. it just goes away doesn't it well if you say it's a good thing that people haven't got the illusion of aaa safety some ways it was a substitute for doing your own homework actually looking a little hood and seeing whether an investment was was a really safe as people said it was their job or are author of the devil's derivative special today inventing many thanks for being on the kaiser arrowtown have to have a thank you all right that's all for this edition of the kaiser report with me max kaiser and stacy herbert i would like my guests are all bloomberg and author of

11:57 am

36 Views

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11